A Guide for Distributors Seeking Positive Change

There is an all-to-commonly held belief that an independent Distributorship – any Distributorship – is

actually just a cash-flow machine. As the belief goes, a Distributorship has few appreciating or marketable assets; perhaps a customer list and a few pieces of office furniture and equipment at best. There is no real machinery, no patents, no software, no real estate – so, little-to-no cashout value at the end of a career

Those who think this way believe the Distributorship business model requires the owner to not only maximize the flow of cash as he goes, but also to wisely – almost masterfully – capture enough cash above operating and living expenses to fund retirement, because it may be difficult to sell a business that is mostly built on relationships at career’s end. There is absolutely nothing wrong with this model, they say, so long as the owner understands the game going in and seizes plenty of cash.

But wait a minute! Is this assessment correct? Could it be that you can manage and maximize your Distributorship’s value and then sell it to supplement a great retirement? Or leverage it to employees for continued revenue? Or simply bequeath something of great value to your family? And if so, how do you maximize that value?

Let’s explore these questions and see if we can find the proverbial light at the end of the tunnel!

YOUR DISTRIBUTORSHIP CAN SURVIVE YOU

There are many ways to maximize the value of a business, of course, because there are a myriad of factors influencing value, some in your control and some not. For this article, we will focus on a few that are often overlooked.

FIRST: YOU CAN “SELL” RELATIONSHIPS

Fact is, businesses that seem to be entirely relationshipbased are bought and sold every day, often for

many multiples of earnings for tidy profits! How is this accomplished?

It is true you cannot sell your personal relationships with your customers. However, you can leverage your relationships to help create healthy, new relationships between your customers and your replacement. It is done every day, every time a key salesman dies or moves away. What’s required is planning and deliberate action. There are three essential phases to successfully maximize the value

of relationships as you transition a relationship-based business: Establish a Timeline, Decide Type of Buyer, and Involve Customers. Let’s explore each.

ESTABLISH A TIMELINE

The Timeline Phase begins with soul-searching and decision-making only you can do. To be sure, your advisors – accountants, financial planners, attorneys, mentors, and peers – offer valuable guidance, but much of this phase is lonely work you do alone.

You cannot reach a goal if you do not set a goal! Begin by setting a target date to transition your business. “I want to be retired with no work obligations by XX(date).” Cut yourself some slack here; dates can be a range of time, such as “fourth quarter of 20XX” or “summer of 20XX.” It could be years away. Remember, you are just getting started, and there are many variables to handle coming up.

The point is to select your “out date” so you can work backwards to plan a timeline for all the things you must accomplish to achieve your “out date”. If you want to be “out” three years from now, you probably need to have your replacement in place no later than two years from now, for example, which may mean you need to start looking for him/her this year or next year. Write down the timeline and enter the key dates but allow yourself room to adjust if circumstances interfere.

Besides the inherent benefits of good planning, your mission is to demonstrate to your future owner and eventually to your customers that you have a plan with a timeline. This increases the value of your business. No one wants to buy or support a business with no plan, no vision of its future, and no determination of continuity.

DECIDE: BUYER OR HEIR?

Almost concurrent with the process of Establishing a Timeframe, you must also face the decision: Will my replacement be a Buyer or an Heir? Either way, the idea is for someone to take over the operation of the distributorship and you get money, either as a lump sum or in payments or a combination of both, but the reality is you are likely to strike a very different deal with an outright Buyer versus a son, daughter, or other relative. You need to know which direction you’re heading.

If you’re at the age and frame-of-mind to even be reading this article, you likely already know whether you have an Heir in the making. Now is the time to face that question and answer it honestly, no matter whether you like the answer or not: “Have I got an Heir who might take this business?” If so, it’s time to talk with them. If not, you’re looking for a Buyer, and remember, that Buyer may be an employee, a vendor, an acquaintance, or even a customer!

If you must find a Buyer, plan how you will go about it.

Most sellers progress through these steps to find a buyer:

1. Explore people I already know (see list above: employee, vendor, etc.); 2. Explore people I do not know well, but I know of (competitors, peers in other markets, wholesalers, etc.); and 3. Hire a Broker to help you find someone.

Finding Business Brokers and executing M&A deals is beyond the scope of this article, but in keeping with our goal of dealing with often overlooked aspects of transitioning a business, think about the impact on the value of your business that can come from simply KNOWING who will run it after you leave!

INVOLVE CUSTOMERS

It is not as difficult as you might expect to broach the subject of exploring the transition of your business with your customers. Think about this for a minute: What if YOU had a vendor who was getting older. What would YOU want your vendor to do? Would you want him to keep working until he just falls over, leaving you to deal with the problem? Or would you prefer that he make a plan that ENSURES YOU ARE

CONTINUALLY SERVED with no interruption of supply? You appreciate a vendor who PLANS to take care of you, and that’s exactly how your customers feel about you.

Being in a trusting business relationship carries with it a responsibility to plan for continuity of service. Your customer will never object to you planning and discussing a transition so long as you ensure him/her you are making the plan for HIS/HER benefit! The conversation may begin something like this:

“John, I’ve been thinking about developing a transition plan for my retirement. Of course, it would be YEARS from now, but that’s the point: I want to make sure I plan far enough ahead to be able to take care of YOU, because your business is extremely important to us. Would you be willing to work with me to accomplish a transition someday?” This approach allows you to adjust to your customer’s reaction, pro or con, and slow down or even speed up if appropriate.

When you have a clear plan with a well-thought-out timeline leading to a pre-determined ownership transition AND YOUR CUSTOMERS APPROVE THE PLAN, you have significantly increased the value of your distributorship.

PROCESS DOCUMENTATION HAS VALUE

Imagine you were buying a business. What knowledge would you ask the seller to impart? You would want to know what worked and didn’t work, right? You would want the seller to describe the sales, ordering, fulfillment, shipping, billing, payroll, and operating processes. You would ask, “How did you handle issue resolution and personnel matters? What are your policies regarding returns, lost shipments, guarantees, items damaged in transit, or customer claims regarding quality or errors? What are your

sales goals and plans?”

Process documentation not only improves business performance, but it also adds value. People who buy and sell businesses for a living (brokers and equity investors) will tell you that process documentation adds value, because it results in consistent performance, more efficient discipline and correction, faster training during periods of expansional growth, and shorter downtime during personnel turnover. It also enables better performance measurement.

Documentation is definitely an ASSET when it comes time to market a business, but often owners of distributorships will say, “I’m a sales guy; I’m not a writer! How am I supposed to document my processes when I barely have time to make my calls and process my orders?!”

If you can make a list, you can document.

Simply record the steps of each process and key points of each policy, and then recruit an intern from a nearby school to observe the process and write descriptive documentation. Interns are often free or work for minimum pay, and they are very eager to please you!

Don’t forget to include your manufacturer or wholesaler in this process, too. Your supplier’s abilities and processes are yours, too! Look at your wholesaler’s policies (usually found in your distributor agreement), guarantees, and written promises. Because you are “an authorized distributor” of that wholesaler, his statements of policy, assurance, and promise are YOURS, too. You represent your wholesaler to the end-user, so all his strengths – or weaknesses – in this area are extremely important to you. If you aren’t sure what your supplying manufacturer has done in this area, just ask! You may be surprised to learn he has defined process and policy that can add value to YOUR business’s documentation – or you may discover it’s time to search for a supply partner who can serve you better!

IMPACT OF THE INTERNET

What did we all do before the Internet? It’s difficult to think of anything more impactful on the way business is conducted. In just a few short years, we have transformed enterprise from being people- and location-centric to now being more about pleasing Google and online operational efficiency. Click, click, click…the order is done, and we just wait for the delivery notice and pic of the box on our front porch. What a change!

The digital transformation affects every aspect of your distributorship. Your customers increasingly expect you to not only keep up, but also lead the way in providing online access to your product line and supply chain.

Let’s face it: No one looking to buy a distributorship wants one with little or no web presence or capability. Well-used websites and established e-commerce platforms add significant value to a distributorship!

You don’t have to reinvent the wheel to get started. Chances are, there is a web firm near you that can guide you to develop a decent website and simply order request process if you don’t have one. The important thing is to tend it, nurture it, and give customers real reasons and benefits to use it. Use special web offers, coupons, special pricing, and other incentives to get started. Then, let your website become a resource for valuable information and fast-response ordering to build a continuing, loyal web audience.

Be sure to include your wholesale manufacturer in your web plans, too. More than likely, he has a web program already in place to support you. Some offer “extensions” of their own websites that you can brand as your own. Others have web “sales channels” such as online catalogs, browsers, shoppers, or actual online ordering systems that you can brand and present as your own.

As a distributor, you do not need to redevelop what has already been developed especially for you. True, you’ll create more value for yourself if you own and utilize your own unique domain name and web address, but you don’t need to invest in developing web transactional processes if they are already being supplied by your wholesaler. Your customer doesn’t care where your online ordering platform came from; he only wants ease and speed of doing business, with the knowledge that YOU, the trusted supplier

and friend, stand behind every order.

Your website and online presence can add tons to the value of your business. If you don’t have it, get it. An effective website is more available than you might imagine.

EBITDA AND OWNER ADD-BACKS

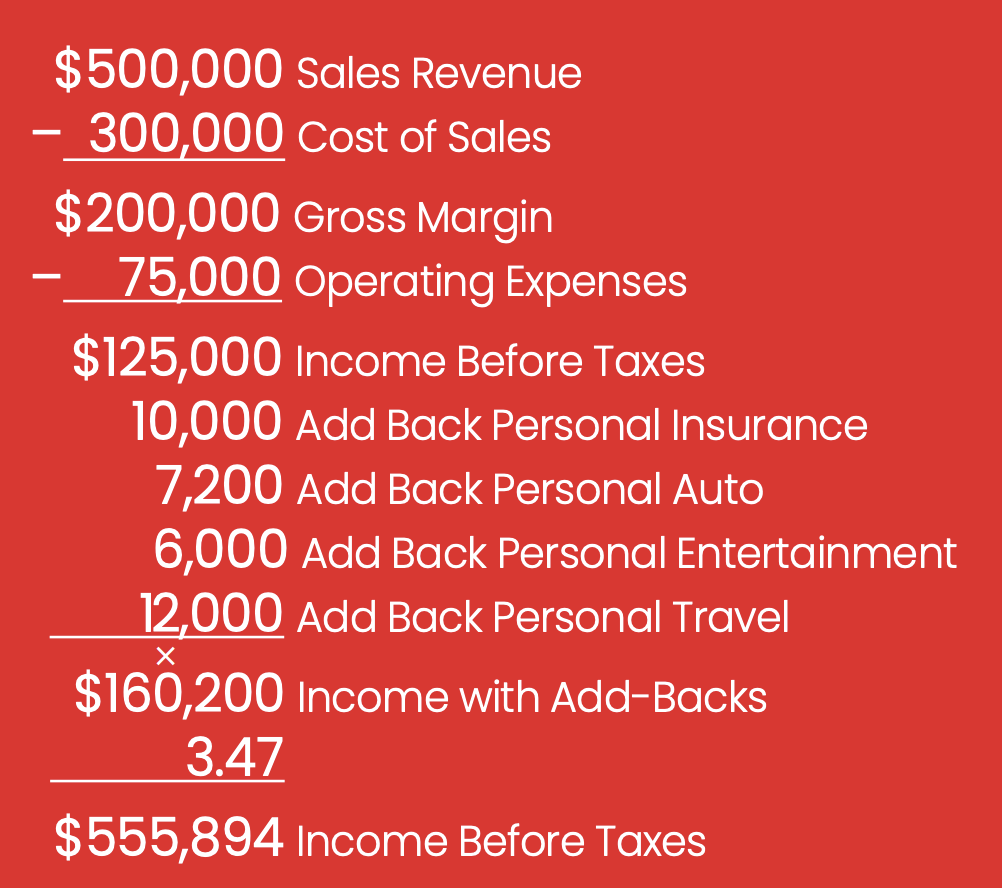

One source, Digital Exits*, reports that one distributor business is sold approximately each week (500 in the past 10 years) and sells for an average multiple of 3.47 times earnings. Let’s look at how you can maximize that calculation.

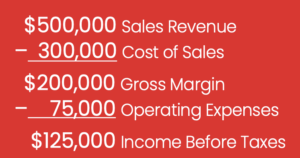

Suppose you have a distributorship with $500,000 in revenue, and your margin is 40% or $200,000. Let’s say your reported operating business expenses are 15% or $75,000, so you’re really making $125,000. It looks like the example above.

Value of the business? 3.47 × $125,000 = $433,750. But that’s the average, right? YOU intend to perform above average! You’re planning on 5 or even 10 times earnings by doing all the things in this article and more.

You can accomplish that goal, but we want to warn you against shooting yourself in the foot along the way. This happens when business owners try to avoid that little word at the very end of the math example shown above…yes, that last word: Taxes.

We all do it. To minimize taxes, we find ways to get our company to pay for things we want in our lives whether we own a company or not. We declare that our life insurance is “key man insurance.” We get the company to buy our car because most of the mileage is business related anyway. And of course, practically all our meals are business lunches and dinners, because we mention a client to our

spouse every chance we get! And of course, practically every trip we take is business-related, right?

Business brokers call these things Owner Add-backs. In other words, when it’s time to put a value on a closely held business, you ADD BACK those items to arrive at the true amount a business generates in cash for its owners. This is in addition to EBITDA (Earnings Before Interest Taxes Depreciation and Amortization), which is a subject for another article (but be sure to learn about it).

Look at the impact of Owner Add-backs:

Whoa! We added over $120,000 – a 22% improvement – to the value. There are two main points to take from this:

- Don’t hide your Add-backs so deep that you can’t show them to a prospective buyer. It’s simple: the more you have on the books, the greater the value of the company at the end. Owner Add-backs are real, accepted, and extremely important when valuing a company.

- Remember that your distributorship’s ultimate value is as a cash-generating machine. Maximize your company’s cash output by utilizing platforms, programs, and systems provided by your wholesale supplier. Avoid spending money to reinvent capabilities your wholesaler already offers for your use!

Like what? Do you really need warehouse and storage space for products your wholesaler could house for you? Do you need fulfillment equipment and staff if your supplier could provide that service? Are you trying to operate Stock-and-Release programs for larger clients? Have you asked your wholesaler if he can provide that service in your name? Are you paying staff to prepare direct mail or customize shipping containers? Could your wholesaler do that?

Perhaps it’s time to have a conversation with our wholesale supplier and explore ways you can minimize

operating costs to maximize cash – and prepare for a great multiple return!

A good return on your Distributorship awaits when it’s time to retire – if you plan for it now

anywhere

anywhere